irs tax levy phone number

To begin the process of an appeal call the. During peak tax season please be patient as wait time can be fairly long.

Irs Bank Levy Release Tax Levy Rush Tax Resolution

If youre unsure which phone number to call about your specific question then.

. Account or tax law. Corey W Hankerson JD EA. The phone number 800 829 7650.

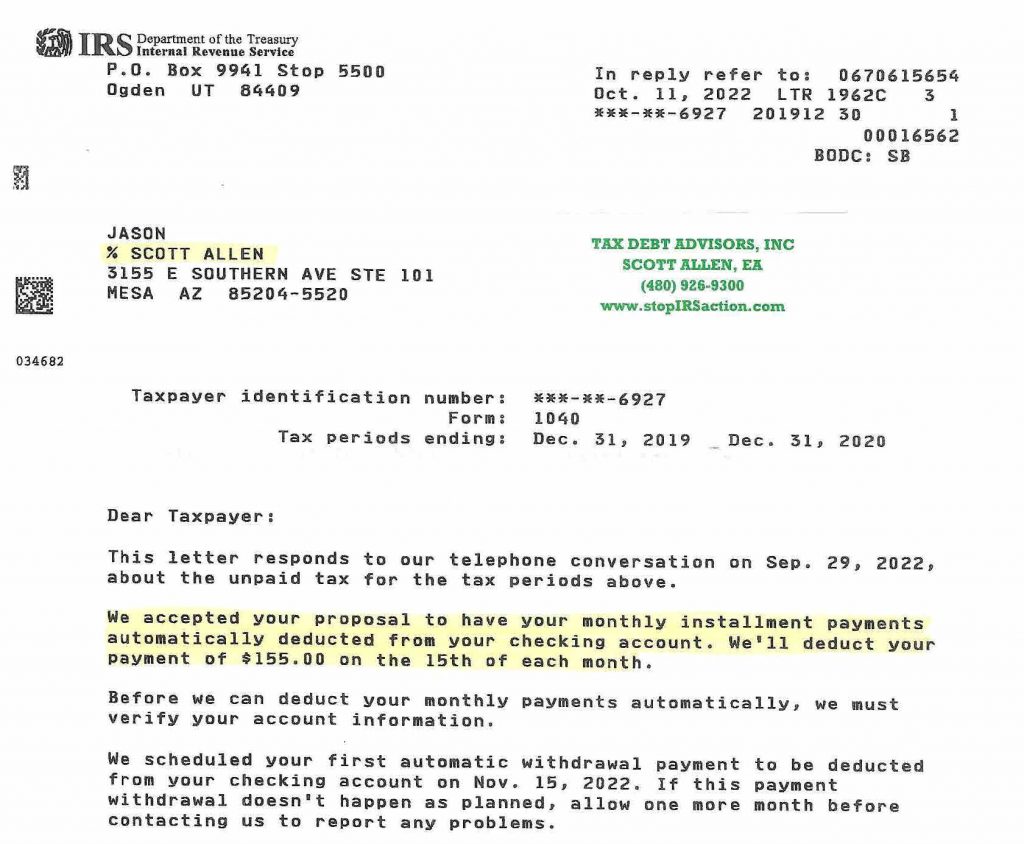

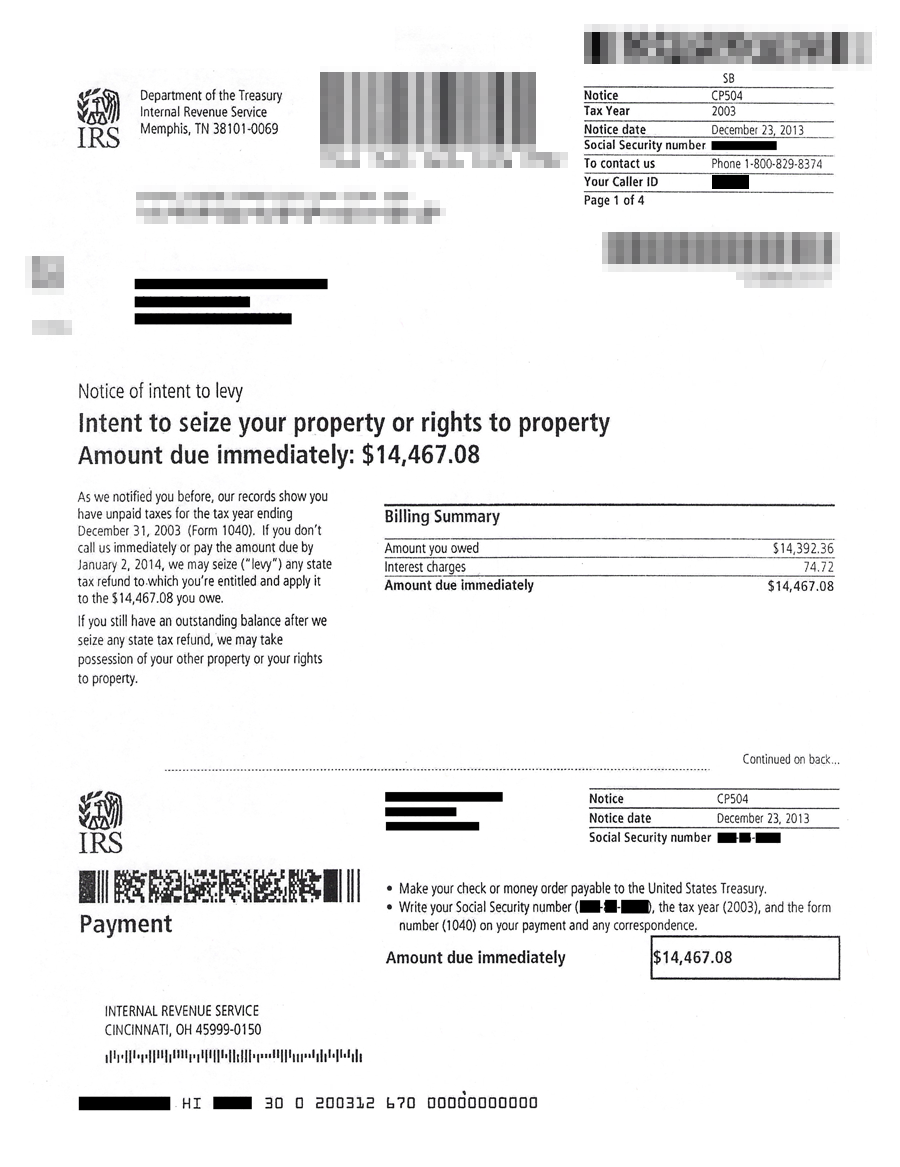

You may apply for a short-term or long-term payment plan. An IRS levy permits the legal seizure of your property to satisfy a tax debt. You have the legal right to appeal a tax levy but you must act quickly as the IRS can start seizing your assets within 30 days of sending the notice.

This IRS phone number is ranked 2 out of 11 because 2306316 IRS customers tried our tools and. You paid the amount you owe and no longer have a balance. The IRS can also release a levy if it determines that the levy is causing an immediate economic.

IRSs 800-829-7650 Federal Payment Levy Program Number. The 100 levy was implemented for. To remove a tax levy youll need to contact the IRS and ask for the levy to be released.

IRS Phone Numbers for Tax Pros. If the IRS denies your request you can appeal whether or not the IRS has already. 1 877 Levy King.

If you do not find the number you need below we encourage you to visit the Let Us Help You page on the IRS. Be prepared to discuss your financial situation with the IRS and explain why you. Resolving your federal tax liabilities with your citymunicipal tax refund through the.

The period the IRS can collect the tax ended before the levy. The IRS also has specific phone numbers for tax professionals. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for assistance.

Contact the IRS immediately to resolve your tax liability and request a levy release. Electronic Products and Services Support e-Help Desk 866-255-0654 Regular Hours of Operation. The IRS is required to release a levy if it determines that.

When a taxpayer ignores the IRS notices about taxes owed the IRS can levy property included wages. The Medicare Access and CHIP Reauthorization Act of 2015 increased the amount of the federal payment levy for Medicare Providers from 30 to 100. One of the questions I get asked a lot from clients when considering a federal tax debt is whether to institute an automatic stay with their state.

If youre a tax pro who needs to contact the IRS use these numbers. It can garnish wages take money in your bank or other financial account seize and sell your. You can request an installment agreement by contacting the IRS tax levy phone number as soon as you receive the notice of the levy.

Contact the IRS and provide information about your bankruptcy chapter the filing date the court where you. Once that is done find the IRS phone number on your IRS levy notice or call 800-829-1040. M - F 630 am.

If youre in bankruptcy the IRS may not be able to levy your assets.

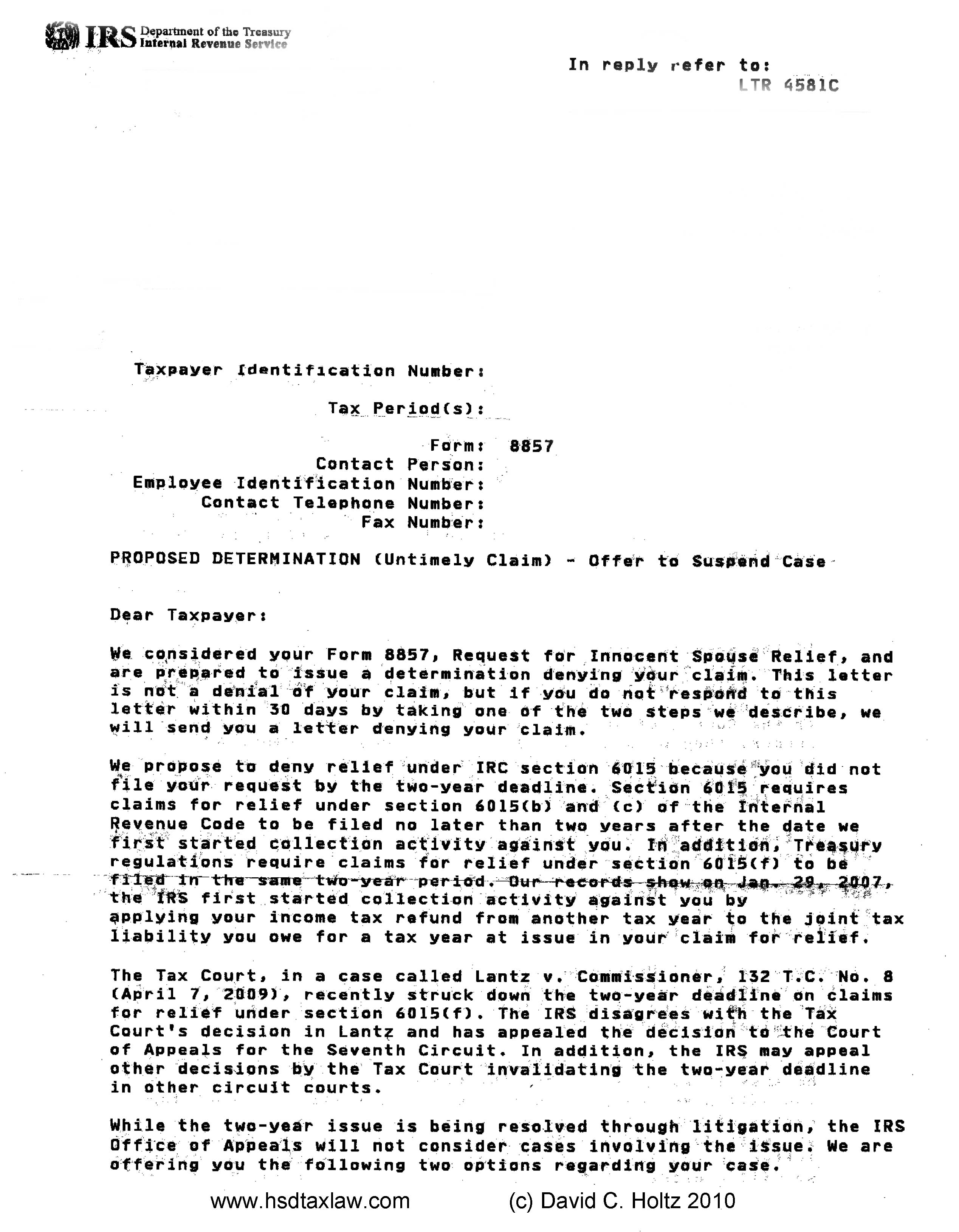

Irs Form Letter 4581c Offer To Suspend Innocent Spouse Case Holtz Slavett Drabkin Aplc

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Letter 2050 Overdue Taxes Or Tax Returns

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Notice Of Levy Will The Irs Seize My Assets Because Of My Unpaid Taxes

Stressed About An Irs Tax Levy Our Experts Can Handle It

Irs State Tax Levy Guide How They Work How To Stop Help

Fun Facts About Irs Bank Levies Washington Tax Services

Stop An Irs Tax Levy And Tax Levy Help From Community Tax

Irs Has Restarted The Income Tax Levy Program

Taxrelief Tecs Did You Receive A Notice Of Intent To Levy Know Your Rights Let The Tec S Help You Handle Your Irs And Or State Tax Debt Call Us Now For A

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

What S The Difference Between A Tax Levy And Lien